401k withdrawal tax calculator fidelity

This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401 k or even your IRA versus rolling it over to a tax-deferred. Pre-tax Contribution Limits 401k 403b and 457b plans.

Choice Between Pre Tax And Roth 401 K Plans Trickier Than You Think

For traditional 401 ks there are three big consequences of an early withdrawal or cashing out before age 59½.

. The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place. The IRS then takes its cut equal to 10 of 16250 1625 reducing the effective net value of your withdrawal to 14625. Years until you retire.

The IRS generally requires automatic. If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your.

Offer Your Clients Lower Costs and Less Complexity with SIMPLE IRAs. May be indexed annually in 500 increments. These tax tools and calculators from Fidelity will help you better assess and calculate the tax implications of your investments.

If you remove funds from your 401 k before you turn. Roth Retirement Savings Plan Modeler. Discover The Answers You Need Here.

Use this calculator to estimate how much in taxes you could owe if. Ad Download Our Program Highlights and Show Clients the Benefits of a SIMPLE IRA Plan. Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance.

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resortNot only will you pay tax penalties in many cases but youre also robbing yourself of. Of course taxes will be due when you withdraw money from your Plan. Also you should remember that the results you receive.

Explore your retirement income stream by using our retirement income calculator. After taking out 12950 in standard deduction his first 10275 of taxable income will be taxed at 10 the remaining 31400 or ordinary income at 12 and because of his. Tax-savvy withdrawal strategies.

401k Calculator A 401k can be one of your best tools for creating a secure retirement. First all contributions and earnings to your. It provides you with two important advantages.

Learn how you can impact how much money you could have each month. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important. Taxes will be withheld.

Use the Contribution Calculator to see the. With this tool you can see how prepared you may be for retirement review and. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator.

Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment.

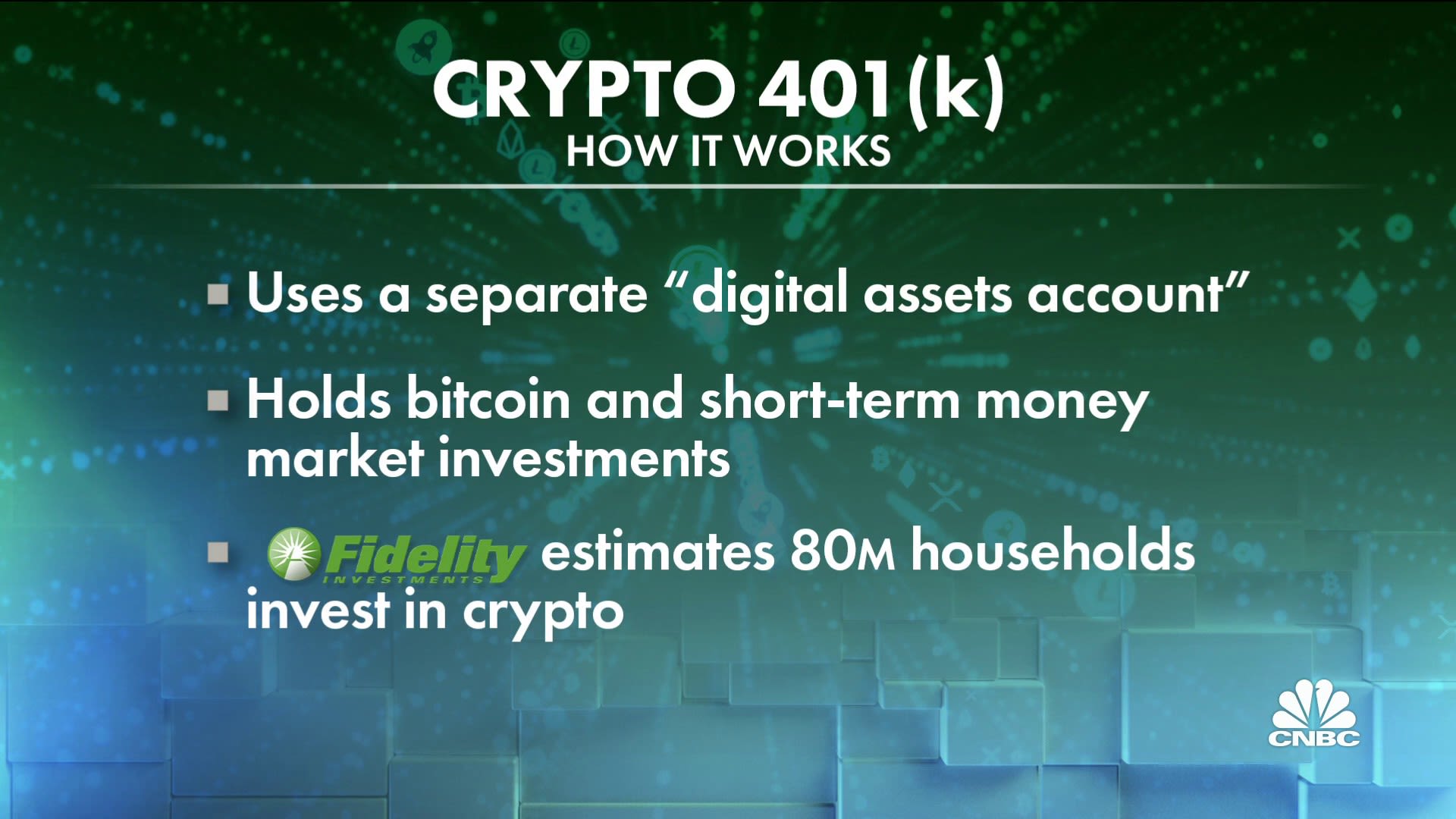

401 K Plan What Is A 401 K And How Does It Work

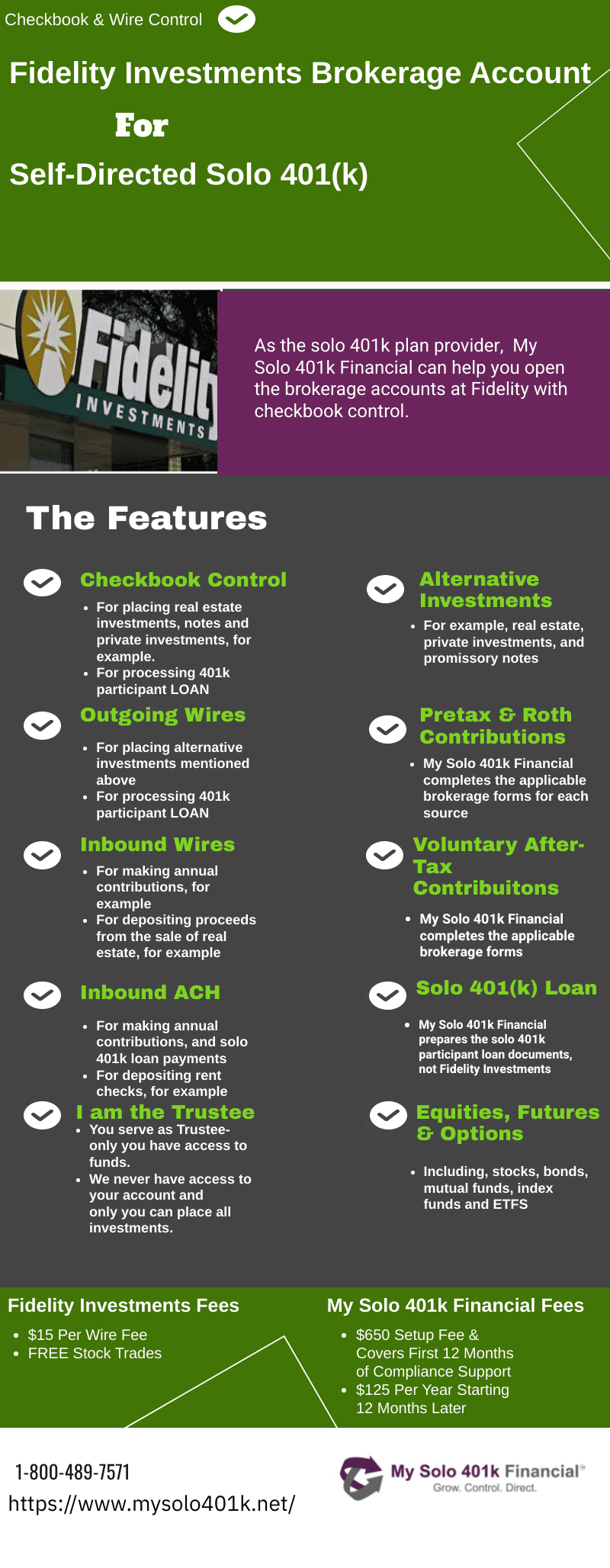

Fidelity Solo 401k Brokerage Account From My Solo 401k

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

Solo 401k Rules For Your Self Employed Retirement Plan

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

My 401 K Is Losing Money How Do I Stop It 2022

Roth 401k Roth Vs Traditional 401k Fidelity

The Ultimate Roth 401 K Guide District Capital Management

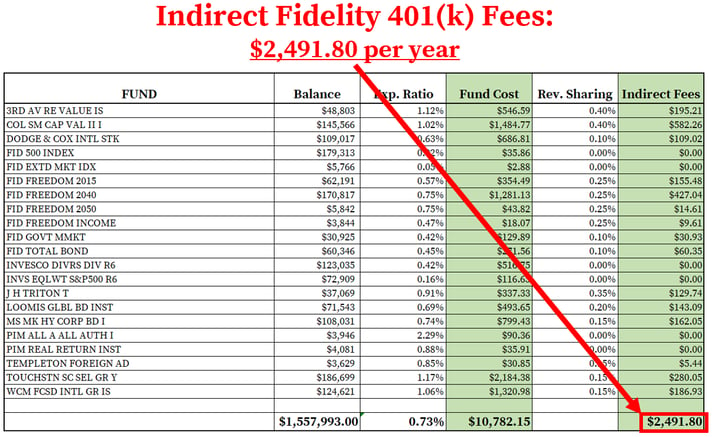

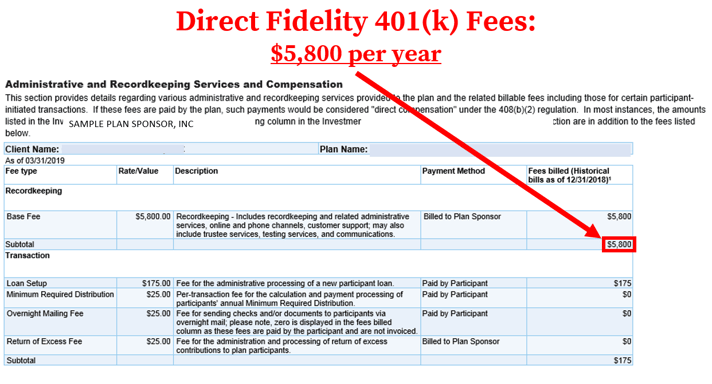

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

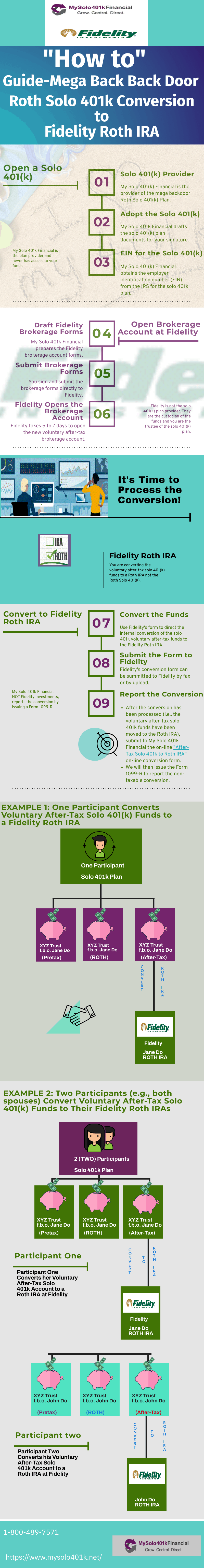

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

How Do I Calculate How Much Money Is Available For A 401 K Loan

How Much Fidelity Bond Coverage Are We Required To Have

Calculate Your Earnings By 401k Withdrawal Calculator 401k Calculator Will Be Providing You The Result For The Opt Saving For Retirement How To Plan 401k Plan

How To Find Calculate Fidelity 401 K Fees

What Happens When You Inherit An Ira Or 401 K